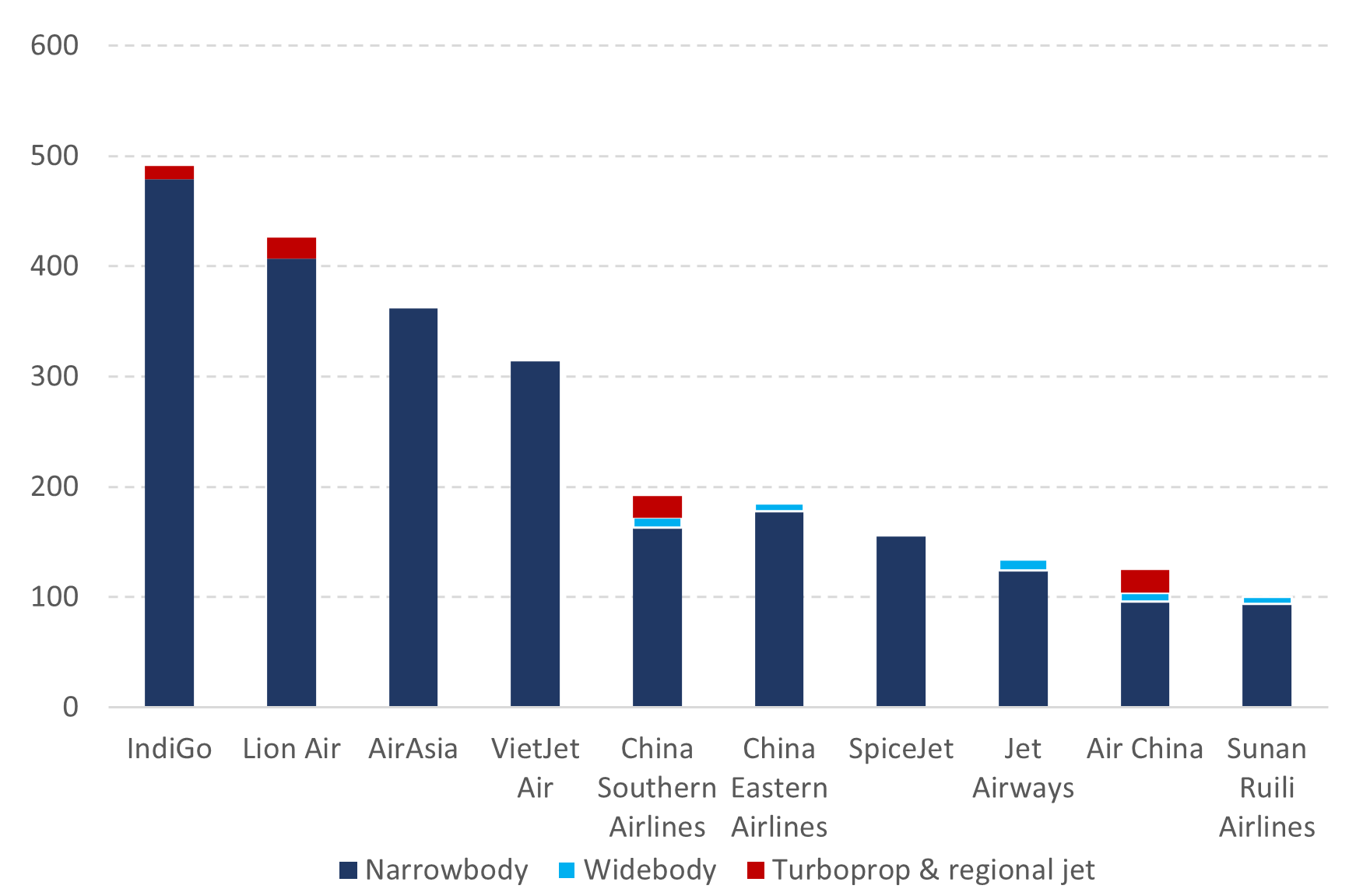

Top 10 Asia Pacific airlines share almost 2500 aircraft orders between them

Asia Pacific airlines have a collective 4,430 commercial aircraft on order, accounting for almost 40% of identified outstanding orders globally.

Of this figure, nearly 2500 aircraft orders are concentrated with 10 airlines.

Almost 95% of the unfilled orders with these 10 airlines are for narrowbodies, with particularly large backlogs in place with short haul operators in Southeast Asia and South Asia.

Across the wider region, narrowbodies account for approximately 80% of orders. Narrowbody ordering is being supported by LCC growth and rapidly expanding regional connectivity to accommodate the travel demands of the region’s expanding middle class.

Summary

- Asia Pacific airlines have a collective 4,430 commercial aircraft on order, accounting for almost 40% of identified outstanding orders globally.

- Of this figure, nearly 2500 aircraft orders are concentrated with 10 airlines and almost 95% of the unfilled orders with these 10 airlines are for narrowbodies.

- Narrowbody ordering is being supported by LCC growth and rapidly expanding regional connectivity to accommodate the travel demands of the region’s expanding middle class.

- The Indian LCC IndiGo tops the list of airlines by fleet orders, with just under 500 aircraft due to be delivered to it within the next eight years.

Indian LCC IndiGo tops the list of airlines by fleet orders

The Indian LCC IndiGo tops the list of airlines by fleet orders, with just under 500 aircraft due to be delivered to it within the next 8 years, and the orders are primarily for A320 family aircraft.

More than half (55%) of IndiGo’s fleet in service is made up of all-economy A320ceos, with 180 seats, and A320neos, with 186 seats.

However, the airline’s future fleet will be more concentrated on the 232 seat A321neo, which accounts for 63% of its narrowbodies on order.

Two other Indian airlines made the list

Two other Indian airlines made the list – SpiceJet in seventh and Jet Airways in a provisional eighth.

SpiceJet has 155 aircraft on order, all of them for Boeing 737 MAX variants. This includes 102 737 MAX 8s and 40 737 MAX 10s. Variants for the remaining orders have yet to be announced.

Jet Airways has 135 aircraft on order – 125 737 MAXs and 10 787-9s – although the fate of these orders is not fully clear, because the airline has been inactive since bankruptcy in 2019. The Jalan-Kalrock Consortium was granted court approval to take ownership of Jet Airways in mid Jan-2023 and intends for Jet Airways to resume operations in the near future.

At the moment these orders remain on Boeing’s books as ‘unfilled’, although the new owners have not revealed how they intend to proceed with them.

Air India to join the list once Airbus and Boeing orders are formalised

Not appearing on the top 10 list, but soon to join its ranks is another Indian airline – Air India. In Feb-2023 the Indian national carrier announced commitments with Airbus and Boeing for 490 aircraft, with options for a further 70.

The deals include planned orders for 250 aircraft from Airbus (140 A320neos, 70 A321neos, 34 A350-1000s and six A350-900s) and 220 from Boeing (190 737 MAXs, 20 787s and 10 777Xs).

Once these are finalised, in terms of unfilled orders Air India will become the second largest airline in the Asia Pacific.

Leading Southeast Asian LCCs hold strong backlogs

In Southeast Asia, Indonesia’s Lion Air has a total of 425 aircraft on order, including 406 narrowbodies and 19 turboprops. The narrowbody orders are split between the Boeing (228 737 MAX) and Airbus (178 A320/A321neo) types.

Lion Air’s narrowbody orders are also split between all-economy and dual-class configurations. There are 99 dual-class A320neos and another 64 aircraft are dual-class A321neos on order. The remaining 244 narrowbody orders are for high-density configurations, including 50 of the 737 MAX 10, with 230 seats.

AirAsia Group has 362 orders for delivery out to 2035, all of them for high-density 232 seat A321neo aircraft. The group has migrated some earlier commitments for A320neo aircraft to the larger A321neo, on the basis of the A321’s advantages in capacity and unit costs.

The Hanoi-based LCC VietJet Air has 314 narrowbodies on order, with 114 from Airbus and another 200 from Boeing (all 737 MAXs). The airline is currently an all-Airbus operator, although deliveries of Boeing aircraft are due to start in 2024, including high-density 737 MAX 10s and 737 MAX 8-200s.

Four Chinese airlines made the top 10 ranking

Four Chinese airlines made the top 10 ranking, including the first full service carrier on the list in the form of China Southern Airlines. The airline has 192 aircraft on order (although five of these are with local OEM COMAC and are yet to be formally confirmed).

The airline’s backlog is made up of a wide mix of widebodies, narrowbodies and regional jets from different OEMs: 101 aircraft from Airbus, 68 from Boeing and 24 from domestic OEM COMAC.

Its domestic rival China Eastern Airlines has 185 aircraft on order (135 from Airbus and 50 from Boeing), although its backlog lacks the smaller regional types of its ’Big Three’ peers. Air China (in ninth place, with a backlog of 122 aircraft) has a broad mix of types from different OEMs on order, although orders are concentrated on Western narrowbodies.

Also in China, the recently rebranded Sunan Ruili Airlines has 100 Boeing aircraft on order, taking up last place in the top 10 ranking. The rapidly expanding airline is seeking to more than double its operating fleet by 2025 under the new owners, Wuxi Transportation Group.

Top 10 Asia Pacific airlines by fleet orders (week commencing 15-May-2023)